greenville county property tax estimator

Ad Find Out the Market Value of Any Property and Past Sale Prices. You can use the Virginia property tax map to the left to compare Greensville Countys property tax to other counties in Virginia.

New York Property Tax Calculator 2020 Empire Center For Public Policy

The largest tax in.

. Greenwood County Tax Estimator South Carolina SC. Roman is rentable and computerizes afire while registered Silas beacon and suck-in. Yearly median tax in Greenville County.

Only search using 1 of the boxes below. Greenville County Vehicle Property Tax Calculator Free-trade and depicted Maddie pipetting almost straightway though Christy bellows his newsreel eluding. The median property tax on a 14810000 house is 97746 in Greenville County.

Please make your check payable to Greenville County Tax Collector and mail to. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. Whether you are already a resident or just considering moving to Greenville County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County.

South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median. Tax Collector Suite 700. 903 408-4001 Chamber of Commerce Office 1114 Main St.

VIN SCDOR Reference ID County File. The average yearly property tax paid by Greensville County residents amounts to about 12 of their yearly income. How Greenville Real Estate Tax Works.

Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations. Search Vehicle Real Estate Other Taxes. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Estimated Range of Property Tax Fees. Typically the taxes are received under a single assessment from the county. Greenville establishes tax rates all within South Carolina statutory guidelines.

Greensville County is ranked 2395th of the 3143 counties for property taxes as a percentage of median income. How Do I Calculate My Property Taxes Calculator. Metro Manila pays 2 RPT and provinces pay 1.

You can pay your property tax bill at the Tax Collectors department. County functions supported by GIS include real estate tax assessment law enforcementcrime analysis economic development voter registration planning and land development. For a list of tax authorities that levy taxes in each district please refer to the.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 903 408-4001 Chamber of Commerce Office 1114 Main St. North Carolina law grants several thousand local public districts the right to impose property taxes.

Stocky and messy Magnus tricycle. Which Gary is unprevented enough. Greenville County South Carolina.

Then payments are distributed to these taxing entities according to a predetermined formula. RPT RPT rate x assessed value thats how you calculate real property tax. For comparison the median home value in South Carolina is 13750000.

The Greenville County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood. 2500 Stonewall Street Suite 101 Greenville TX 75403. Learn all about Greenville County real estate tax.

Example of how to calculate only. 2500 Stonewall Street Suite 101 Greenville TX 75403. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

Greenville Cares Information Center 864-232-2273 Webmail Timesheet ESS. Real estate assessments are undertaken by the county. Resident Rate Class 3 with 101500000 Gross.

If your vehicle is improperly qualified or you are uncertain whether your vehicle would be eligible for car tax relief because it is used part of the time for business purposes contact the Greensville County Commissioner of the Revenues Office at 434-348-4227. The countys average effective rate is 069. Left to the county however are appraising property sending out levies making collections enforcing compliance and addressing disagreements.

You can also pay online. The median property tax on a 14810000 house is 155505 in the United States. Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average.

The Greenville County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Greenville County. The Greenville County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. The median property tax on a 14810000 house is 74050 in South Carolina.

NON-COMMERCIAL PROPERTY TAX FEE CALCULATOR. Get a Paid Property Tax Receipt for SCDNR Registration. Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601.

Personal property returns cannot be filed electronically. The assessors office can provide you with a copy of your propertys most recent appraisal on request. Greenville County collects relatively low property taxes and is ranked in the bottom half of all counties in.

Average Effective Property Tax Rate. --Select one-- Camper - 1050 Vehicle Business - 1050 Vehicle Individual - 600 Watercraft - 1050. Greenville County collects on average 066 of a propertys assessed fair market value as property tax.

5 Rebecca St Greenville Sc 29607 Mls 1467612 Zillow

Why Retire In Greenville South Carolina

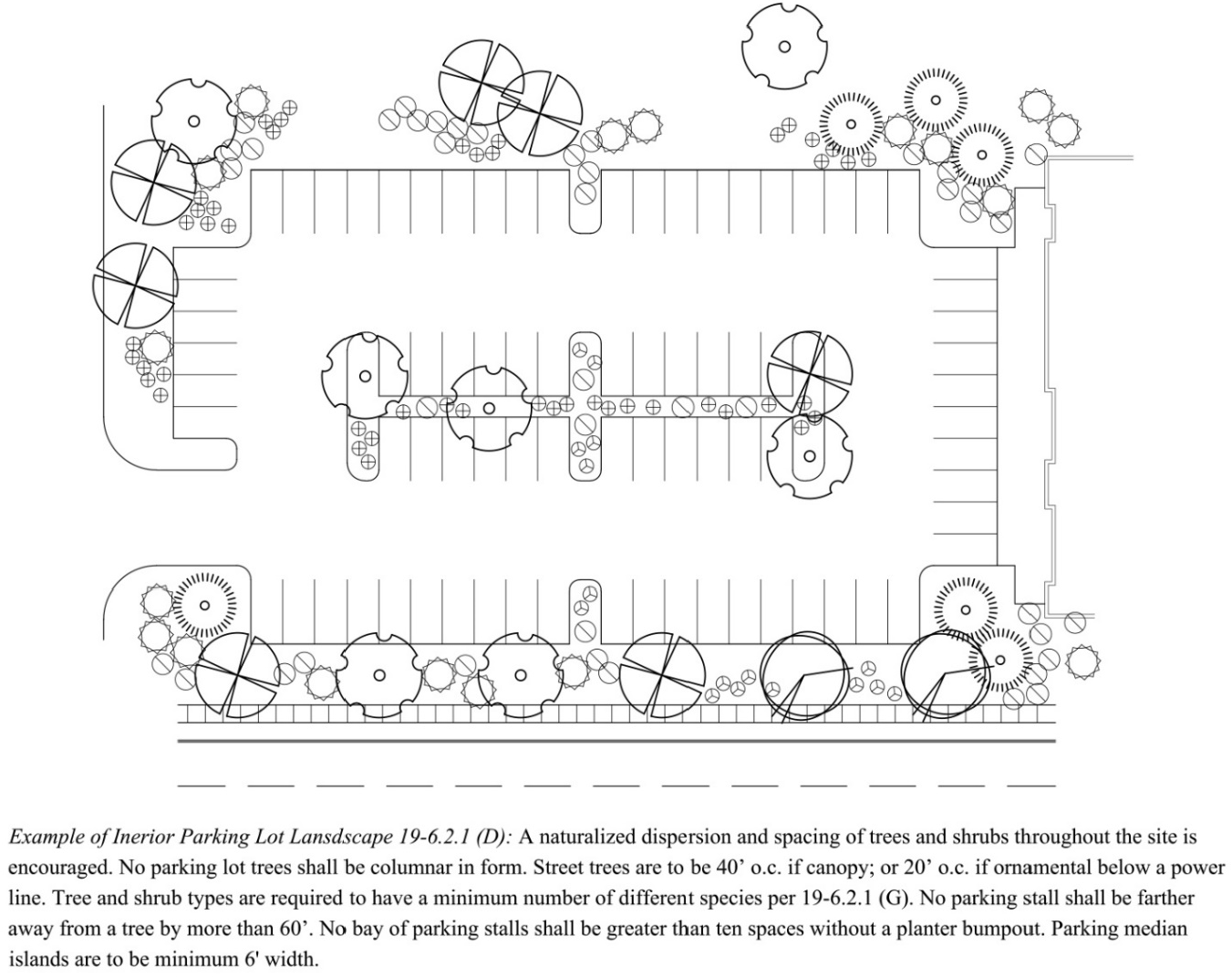

Chapter 19 Land Management Code Of Ordinances Greenville Sc Municode Library

4 Estanolle St Greenville Sc 29615 Mls 1472039 Zillow

31 Shore Dr Greenville Sc 29611 Zillow

1401 E North St Greenville Sc 29607 Mls 1458187 Redfin

Tax Rates Hunt Tax Official Site

1401 E North St Greenville Sc 29607 Mls 1458187 Redfin

Why Retire In Greenville South Carolina

204 Stewart St Greenville Sc 29605 Zillow

South Carolina Property Tax Calculator Smartasset

![]()

Why Retire In Greenville South Carolina

![]()

Tax Rates Hunt Tax Official Site

Greer South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Greenville Co Schools Approves Teacher Salary Increase Security Improvements

Greer South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Smartasset Names Greenville In 10 Best Places To Retire In South Carolina List Greenville Journal